24 April 2020

In February, we ran a workshop series to get businesses ready to apply for finance. Grant Thornton UK LLP, part of the Grant Thornton network of independent assurance, tax and advisory firms, shares some of the key information from this series below.

Mark Robson, from Grant Thornton UK LLP’s financial modelling team, shares the key principles behind negotiating an equity stake with your investors

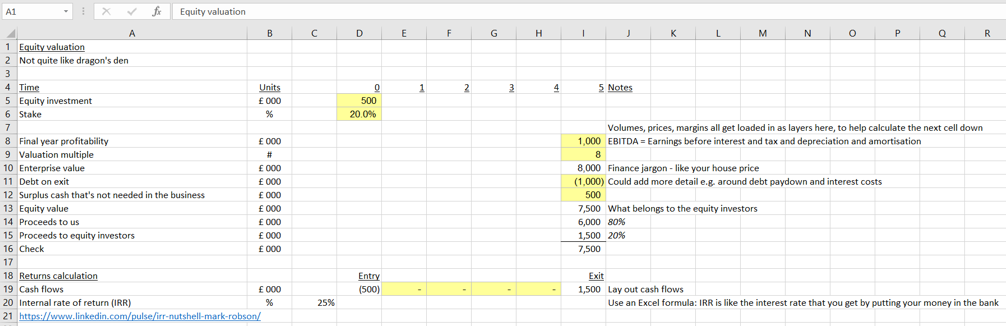

This is not quite like the “Dragon’s Den” style negotiation you see on television. It’s not quite as simple as the investor saying “I will invest £500k for 25%” and the owner responding “Well I’d like to take your £500k but I’m only going to give you 20%”. Real life is a little more complex.

The basics of the discussion do involve the amount of money required (£500k in our example) and the equity stake on offer but there are a few other factors involved as well, namely:

Expected return: the return the investor wants to make on their money, representing their reward for the risk they are taking. An equity investor might tell you that they want to crystallise their return by selling alongside you in five years’ time and that they want to have tripled their money over that period. That’s equivalent to an approximate 25% return each year (£500k increased by 25% each year for five years becomes just over £1.5m).

Expected profits: the profits the business will likely be making at the five-year mark which, in turn, influence…

Expected sale valuation: what the business could sell for in five years’ time. Businesses are typically sold based on a multiple of profits with the multiple often referenced to the valuations of similar businesses (“Businesses like yours often sell for a multiple of [X] times profits”).

It’s clear that the recipe is slightly more complex than that illustrated on Dragon’s Den. Yes, equity investment (£500k) and equity stake are in the mix, but so are expected profits x valuation multiple and the expected return for the investor upon sale.

You can see these factors coming together in the framework below. In this example we have:

From this example, if we were the owner and we awarded a 20% stake to an investor, we can clearly show them how they might get their desired 25% target return. We can also demonstrate how a higher equity stake would result in a greater share of sale proceeds and a higher return, and that a lower stake would mean accepting a lower forecasted return.

Thankfully, the number crunching around equity stakes, once you understand the recipe, isn’t exceptionally complex. Using the framework above, the outcome of the negotiation is going to be influenced by:

It’s usual for there to be a financial model that results in a forecast for profits at the five-year point (in our example the £1,000k). That means, in order to do get the best out of your conversations with potential investors, you’d do well to work hard on building a coherent set of forecasts.

For people who like Excel – that all counts as great news!

Excel financial modelling at Grant Thornton UK LLP

Mark and his colleagues were born on planet Excel. They create financial forecasts for a living (not just because they love it) and take great pride in building models for business of all kinds.

Talk to Mark Robson or Rob Bayliss to find out more.

Back